You wouldn’t ask an electrician to look at your leaky faucet, so why would you ask an investment manager what kind of trust to use to ease the burden of probate on an estate, or how to structure the buy/sell agreement for a business?

These topics are not necessarily in their skill set or job description. While investment management is a crucial part of wealth management, the two are not synonyms.

Additionally, there are multiple ways to pay for these services:

Transaction/Product-Based Commissions

A broker or salesperson provides commission-based product solutions to clients, and gets paid based on the number and/or amount of transactions made for the client. This type of compensation is most appropriate for one-off situations, such as a stand-alone life insurance purchase or speculative individual stock trade, but if a client requires ongoing unbiased advice and more comprehensive services, this is usually not the best solution, as it is laden with conflicts of interest.

Assets Under Management (AUM) Fee

An investment manager/advisor provides fiduciary services in exchange for a fee based on a fixed annual percentage of the investment portfolio being managed for the client. This fee structure aligns the incentives of the advisor well with the goals of the investor when it comes to pure investment management and growing the portfolio, but when applied to broader wealth management, it provides no compensation or incentive for the advisor to work on estate planning, employer/employee benefits, or business-related planning (even if they say they are going to do this for you).

One-Time Fee

A fiduciary financial planner or wealth manager constructs a financial plan for a singular payment (typically paid half up front and half on delivery of a plan). While this goes a long way toward ensuring the advisor will look at multiple planning aspects and maintain an unbiased perspective, it provides no incentive for ongoing advice and updating the planning after the initial plan is delivered.

Retainer Fee

A fiduciary financial planner or wealth manager constructs a financial plan and updates it with ongoing advice perpetually for a monthly or quarterly fixed dollar amount fee. This provides the benefit of having the advisor look at all planning aspects from an unbiased perspective (not just investment management), and provides an incentive for him/her to continuously update the planning and provide advice for as long as the client continues to pay the fee. Often an initial living expense and budgeting analysis alone can improve cash flow enough to more than offset the cost of the monthly fee.

Combinations of All the Above

Some advisors/firms may use more than one of the above methods to provide the best arrangement to service the client’s particular scenario.

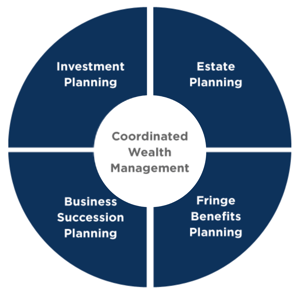

One way to explain the difference between wealth management and investment management is to point out the four quadrants of wealth management. Investment management is one of these four quadrants, but is not the only part of the program. Other areas include estate planning, business succession, and fringe benefits planning. Each is an integral part of the wealth management process, and paying an advisor a retainer fee for these purposes allows him/her to ensure all four are in sync and the client will avoid any future headaches.

One way to explain the difference between wealth management and investment management is to point out the four quadrants of wealth management. Investment management is one of these four quadrants, but is not the only part of the program. Other areas include estate planning, business succession, and fringe benefits planning. Each is an integral part of the wealth management process, and paying an advisor a retainer fee for these purposes allows him/her to ensure all four are in sync and the client will avoid any future headaches.

It is common for advisors to verbally claim to offer investment management and wealth management under a singular fee plan based off assets under management (although very few of them will put this in writing). This is often not as advantageous or productive as it could be for the client (or advisor), because the advisor is not motivated to go and do what’s necessary to optimize a client’s financial life beyond the investment management aspect in this arrangement. (They are not being paid directly for anything other than managing your portfolio—they’re just doing the other three aspects as a value-added “bonus” with their investment management services.)

However, using a retainer fee arrangement for comprehensive wealth management purposes offers the advisor the motivation to fully commit to all four aspects of the broader plan and give the client an unbiased opinion that is not clouded by the need to sell unnecessary products, or the incentive misalignment of being compensated only for portfolio management.

The continuous involvement of an advisor in a client’s fiscal life under a retainer fee arrangement provides a greater likelihood that any advice rendered is also properly implemented over time. A financial plan done with a one-time fee is very susceptible to being framed out and given to the client, but because no one is compensated to follow up and get it done, the plan falls to the wayside and is never implemented correctly. But an advisor on retainer can continuously make improvements and modifications to the plan as the client’s situation and needs evolve, and can follow up to ensure things actually get done, as planned. If at any point the client thinks the retainer fee advisor is no longer doing enough work to justify their fee, they can simply stop paying it.

Retainer fee wealth management is applicable to families, privately held business owners and corporate professionals, and can be tailored to fit any situation. An advisor’s continuous involvement, as pointed out above, is likely to cause an improvement in one’s financial life based on the heightened level of coordination, knowledge, and organization that they will bring to the table. The initial living expense and budgeting analysis alone can show the client’s pain points, and often monetarily justifies the need for an advisor on retainer.

4Thought Financial Group

4Thought Financial Group is a Syosset, NY-based wealth management firm specializing in helping clients achieve their financial goals through a data-driven Multi-Method Investment strategy. It is a proponent of retainer fee-based fiduciary advice, and a Registered Investment Adviser (RIA) that always has clients’ best interests in mind.

As opposed to wealth management services demanding a high, one-time fee, 4Thought Financial Group advocates for those with a low, ongoing retainer fee, with No Contractual Term Commitment. These prove the advisor’s commitment to sustained guidance toward meeting client objectives.

Leave a Comment