Earn New York State Continuing Professional Education (CPE) Credits and Learn New Techniques to Help your Clients and Enhance Your Services

Register for 4Thought’s live or virtual CPA CPE classes to expand your knowledge base in numerous Wealth Management, Financial Planning, and Investment Advisory topics relevant to CPAs that further drive the success of both your business and your clients.

- Gain a fresh perspective and a new understanding about a range of topics related to Comprehensive Wealth Management and Investing.

- Increase revenue and decrease client attrition by learning about the most significant wealth management topics and corresponding best practices that are easy for CPAs to implement for their practice.

- Attract new business and deepen existing relationships from gaining wealth management knowledge to compliment your accounting practice and promote yourself as a center of influence.

Wealth management and investment advisory training in-person or virtually via an online, interactive classroom.

Learn the fundamentals of Coordinated Wealth Management

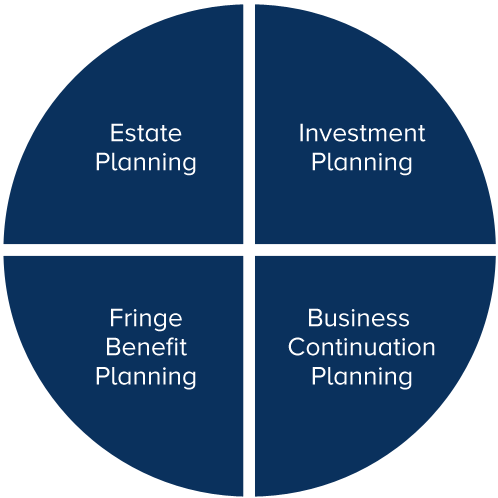

Gain an understanding of how coordinating the “Four Corners” of Wealth Management can improve upon your clients’ existing financial planning, save on income and estate taxes, and prevent any unanticipated future headaches.

Classes are offered either in-person at our Syosset, NY location or virtually via an online, interactive classroom with Microsoft Teams. Private in-person or virtual training may also be requested at the CPA firm level so that your entire staff can earn credits at the same time.

Course topics include:

Estate Planning

› Review of Current Tax Law & Impact of Intestacy

› Wills, Living Trust, Testamentary

› Trust, Revocable & Irrevocable

Fringe Benefits

› 401Ks

› Profit Sharing

› Defined Benefit

› Group Insurance

Investment

› Identifying client investment objectives & gathering data

› Investment planning concepts

› Basic investment portfolio theory

› Types of investment vehicles

Business Succession

› Keep vs. Sell

› Cross Purchase

› Entity Purchase

› Will or Gift

Estate Planning

› Review of Intentionally Defective Grantor Trusts

› Charitable Remainder Trusts

› Charitable Lead Trusts

› Generation Skipping, etc.

Fringe Benefits

› Cash Balance Plans

› ESOP

› Split Dollar

› Captive Insurance/831b

Investment

› Alternative Methods of Investing

› Portfolio Tax Efficiency

› Advanced Investment Portfolio Theory

› Alternative Views on Markets

Business Succession

› Partnership Buy-Sells

› Trust Buy-Sells

› One Way Buy-Sells

Learn about how these important topics help you better service and understand your clients

Our classes help you position yourself as a knowledgeable center of influence. The coursework covers various wealth management and investment advisory topics that help you stand out among other professionals. We cover topics that range from basic estate planning and investing theory to complex business succession and tax planning considerations for small business owners. Best of all, CPAs receive New York State CPE credit, plus ongoing support so they can better serve their clients and provide objective advice.

May 14, 2026

Noon - 2pm

Qualified Plans Overview and Updates

+ Financial Markets Update

Judy Lynch, QPA, Vice President of Consulting Services - Long Island Employee Benefits Group

Jesse Mackey, Chief Executive Officer/ Chief Investment Officer - 4Thought Financial Group

2 CPE Credits - Register Below

June 18, 2026

Noon - 2pm

Best Practices in Investment Portfolio Management

+ Financial Markets Update

Jesse Mackey, Chief Executive Officer/ Chief Investment Officer - 4Thought Financial Group

2 CPE Credits - Register Below

July 16, 2026

Noon - 2pm

Estate Planning Overview and Updates

+ Estate Planning Uses of Life Insurance

Martin E. Levine, CPA, Chief Marketing Officer - 4Thought Financial Group

Kim M. Smith, Owner - Kim Smith Law Group, PLLC

2 CPE Credits - Register Below

August 20, 2026

Noon - 2pm

Labor Law for Small Business Owners

+ Financial Markets Update

Elana Henderson, Partner - Franklin, Gringer & Cohen, P.C.

Jesse Mackey, Chief Executive Officer/ Chief Investment Officer - 4Thought Financial Group

2 CPE Credits - Register Below

September 17, 2026

Noon - 2pm

Identifying Client Financial Needs

+ Financial Markets Update

Daniel Mackey, Chief Financial Officer/ Investor Relations Officer - 4Thought Financial Group

Jesse Mackey, Chief Executive Officer/ Chief Investment Officer - 4Thought Financial Group

2 CPE Credits - Register Below

October 22, 2026

Noon - 2pm

Bear, Bull, Wolf, Eagle Markets and Multi-Method Investing

+ Financial Markets Update

Jesse Mackey, Chief Executive Officer/ Chief Investment Officer - 4Thought Financial Group

2 CPE Credits - Register Below

November 12, 2026

Noon - 2pm

Financial Planning for the CPA Client

+ Financial Markets Update

Martin E. Levine, CPA, Chief Marketing Officer - 4Thought Financial Group

Jesse Mackey, Chief Executive Officer/ Chief Investment Officer - 4Thought Financial Group

2 CPE Credits - Register Below

TUESDAY, JANUARY 28

Noon-2pm

The SECURE Act

4Thought Financial Group

6851 Jericho Tpke, Suite 120, Syosset, NY 11791

Brian C. Mackey, CEO - 4Thought Financial Group

Martin E. Levine, CPA, CFO - 4Thought Financial Group

- 2 CPE Credits

THURSDAY, APRIL 30

Noon-2pm

Review of Legislative Updates Under The CARES Act

VIRTUAL EVENT

Glenn J. Franklin, Esq - Franklin, Gringer & Cohen, P.C.

- 2 CPE Credits

Register Below

WEDNESDAY, MAY 20

Noon-2pm

Intergenerational Planning

4Thought Financial Group

6851 Jericho Tpke, Suite 120, Syosset, NY 11791

Brian C. Mackey, CEO - 4Thought Financial Group

Martin E. Levine, CPA, CFO - 4Thought Financial Group

- 2 CPE Credits

THURSDAY, JUNE 18

Noon-2pm

Social Security & Medicare

4Thought Financial Group

6851 Jericho Tpke, Suite 120, Syosset, NY 11791

Kevin Lawrence, Director of Medicare Sales - Professional Group Plans

Martin E. Levine, CPA, CFO - 4Thought Financial Group

- 2 CPE Credits

THURSDAY, JULY 23

Noon-2pm

Special Needs Planning

4Thought Financial Group

6851 Jericho Tpke, Suite 120, Syosset, NY 11791

Kim M. Smith, Owner - Kim Smith Law Group, PLLC

- 2 CPE Credit

THURSDAY, AUGUST 20

Noon-2pm

Qualified Plan Update

4Thought Financial Group

6851 Jericho Tpke, Suite 120, Syosset, NY 11791

Judy Lynch, QPA, Vice President of Consulting Services - Long Island Employee Benefits Group

Jesse Mackey, CIO - 4Thought Financial Group

- 2 CPE Credits

WEDNESDAY, SEPTEMBER 23

Noon-2pm

Understanding Risk in Investing

4Thought Financial Group

6851 Jericho Tpke, Suite 120, Syosset, NY 11791

Jesse Mackey, CIO - 4Thought Financial Group

- 2 CPE Credits

THURSDAY, OCTOBER 22

Noon-2pm

Medicaid Planning & Long-Term Care

4Thought Financial Group

6851 Jericho Tpke, Suite 120, Syosset, NY 11791

Nancy Burner, Esq., CELA, Founder - Burner Law Group, P.C.

Martin E. Levine, CPA, CFO - 4Thought Financial Group

- 2 CPE Credits

THURSDAY, NOVEMBER 19

Noon-2pm

Estate Planning Update

4Thought Financial Group

6851 Jericho Tpke, Suite 120, Syosset, NY 11791

Kim M. Smith, Owner - Kim Smith Law Group, PLLC

Brian C. Mackey, CEO - 4Thought Financial Group

- 2 CPE Credits

THURSDAY, DECEMBER 17

Noon-2pm

Business Continuity Case Study

4Thought Financial Group

6851 Jericho Tpke, Suite 120, Syosset, NY 11791

Brian C. Mackey, CEO - 4Thought Financial Group

- 2 CPE Credits