As trusted advisors, CPAs are in the perfect advisory roles to help their clients ensure that at death, problems are minimized. This course will include technical insights, as well as case studies, highlighting issues the right estate plan can resolve. It will also identify potential opportunities for clients in the advent of proposed federal tax reforms.

Estate planning is one of the most important financial strategies for CPAs and clients to understand. It’s not a one-time session, but rather, a constant process that should continuously be revisited and modified to account for changes in the market and clients’ evolving financial goals. Creating a will, establishing trusts, naming beneficiaries, and minimizing financial burdens to loved ones are all critical components of proper estate planning.

The prospect of substantial tax reforms—the possible elimination of the estate tax, among these—has raised questions and uncertainty. It’s also created potential opportunities. This course will teach CPAs how to optimize client relationships with practical estate planning advice amid a changing tax landscape.

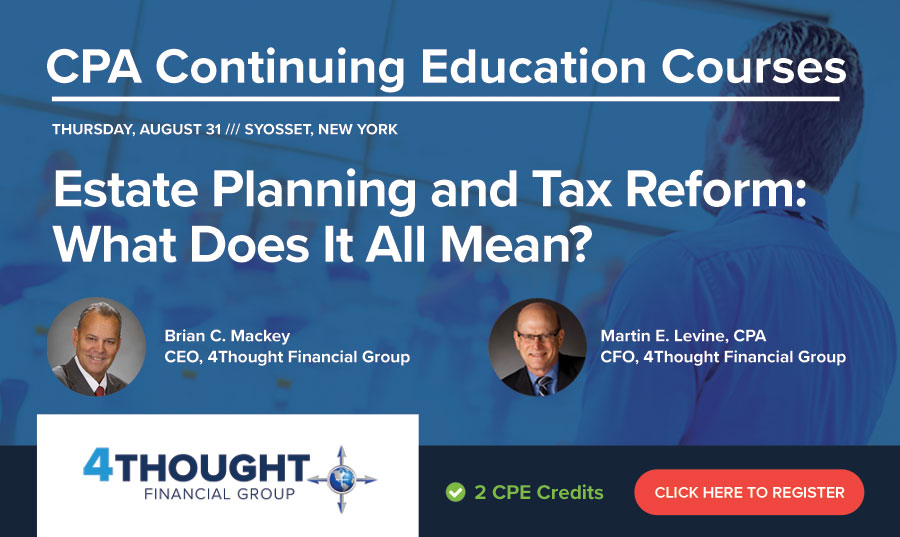

4Thought Financial Group will be hosting an informative, 2 CPE credit-eligible seminar on estate planning and tax reform on August 31, from 8 a.m. to 10 a.m. A light breakfast will also be served.

Click Here To Register

Investment Advisory Services offered through 4Thought Financial (APA)an SEC Registered Investment Advisor. This material is for informational purposes only. Please consult your tax, legal or accounting professional for further information before making any decisions.APFS Compliance has conducted its review of the PMR electronic submission related to your outside RIA material. Any references to our PMR noted comments and changes are crucial if indicated. Please be advised the outside RIA’s CCO is responsible for approval and accuracy of the submission.

Leave a Comment